It appears Sony may be stepping away from manufacturing smartphones in its own facilities. Recent developments suggest the tech giant will increasingly rely on outside companies to build its Xperia phones. This shift includes even their high-end models. If accurate, this will definitely kick-start conversation among fans and industry experts.

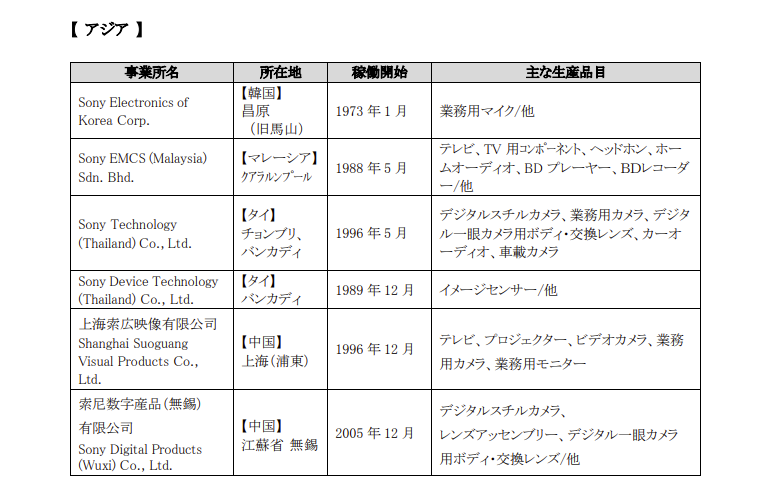

Indications of this change surfaced when, as Japanese tech site SumahoDigest first noted, “smartphones” quietly vanished from the list of main products manufactured at Sony’s own production sites. An update to Sony’s official website in mid-May reportedly no longer lists smartphones under its factory profiles in Thailand, specifically the Chonburi and Bangkadi plants previously known for Xperia production. The Wuxi factory in China, which had also been part of Sony’s manufacturing footprint, similarly shows no mention of smartphone production.

This points to a significant strategy pivot. It suggests that current and future Xperia devices, including the recently unveiled Xperia 1 VII, are likely to be OEM products, meaning they’ll be assembled by external contractors rather than Sony itself. While Sony has used third-party manufacturers for some budget models in the past, the idea of its flagship phones being outsourced is a newer development. The Japanese outlet highlighted that this isn’t just a temporary measure but seems to be Sony’s ongoing policy for the future.

Concerns have naturally bubbled up. Some long-time users are wondering if this will impact the quality and the distinct “Sony feel” that the brand has cultivated. The “Made in Thailand” label on high-end Xperias was, for some, a mark of Sony’s commitment to quality control. Indeed, reports earlier this year, also covered by SumahoDigest, mentioned some users receiving Xperia 1 VII units labeled “Made in China,” sparking initial surprise.

Of course, manufacturing in China doesn’t inherently equate to a drop in quality. Many top tech companies, Apple included, rely on Chinese OEM manufacturers known for their advanced capabilities. So I doubt fans should be worried about any noticeable degradation in quality.

This is quite a turnaround from just a few years ago. Back in 2019, Reuters reported Sony was closing its Beijing smartphone plant to cut costs, with the intention of consolidating smartphone production at its Thailand facility. The goal then was to make its mobile division profitable. At that time, Sony affirmed its commitment to the smartphone business, viewing it as central to future 5G technology, despite its then-struggling market share.

The smartphone market remains fiercely competitive. As Tech Advisor writer Anyron Copeman recently opined, Sony’s smartphone division has been a “curious failure” despite the company’s strength in other tech areas like cameras, TVs, and gaming. He pointed out that despite making Android phones since 2008, Sony hasn’t become a leading brand in the West, lagging behind numerous competitors in global market share.

This latest news about halting in-house production could be a further step in Sony’s evolving strategy to navigate the challenging mobile landscape. It seems the focus may be shifting towards leveraging external expertise for manufacturing, while Sony concentrates on design, technology, and brand experience, a test of balancing brand value with a new production model. Whether this pays off or not remains to be seen.

TechIssuesToday primarily focuses on publishing 'breaking' or 'exclusive' tech news. This means, we are usually the first news website on the whole Internet to highlight the topics we cover daily. So far, our stories have been picked up by many mainstream technology publications like The Verge, Macrumors, Forbes, etc. To know more, head here.