TikTok, the viral video app that’s taken the world by storm, is once again at the center of a geopolitical tug-of-war. But while the U.S. government debates banning the app over national security concerns, ByteDance’s American investors are shrugging off the drama, betting big on the company’s booming Chinese business to keep the cash flowing.

The U.S. House of Representatives recently passed a bill that could force ByteDance, TikTok’s Chinese parent company, to sell the app or face a ban. While this might sound like a doomsday scenario for TikTok’s 170 million American users, ByteDance’s backers aren’t losing sleep. Why? Because TikTok’s U.S. operations are just a small slice of ByteDance’s massive global pie.

TikTok’s U.S. woes vs. ByteDance’s China boom

According to Bloomberg, TikTok’s U.S. business accounts for only about 10% of ByteDance’s global revenue. Meanwhile, ByteDance’s China operations are thriving, with apps like Douyin (China’s version of TikTok), news platform Toutiao, and an AI-powered chatbot called Doubao, which rivals DeepSeek.

Mitchell Green, founder of Lead Edge Capital, summed it up perfectly: “Most people still don’t grasp the scale of ByteDance’s China business, or how small the U.S. actually is in the bigger picture.” ByteDance isn’t just a TikTok factory — it’s a tech titan with its fingers in everything from e-commerce to advertising.

If TikTok gets the boot in the U.S., ByteDance could lose access to the world’s largest advertising market. But here’s the twist: a ban might not be the end of the world for ByteDance’s investors. In fact, some see it as an opportunity to cash in.

Analysts estimate that TikTok’s U.S. business could fetch anywhere from $20 billion to $150 billion in a sale. That’s a hefty payday for ByteDance’s shareholders, including big names like Susquehanna International Group, General Atlantic, and Sequoia Capital. Susquehanna alone could pocket up to $13.5 billion if TikTok sells at the high end of that range.

But ByteDance isn’t rushing to sell. The company has repeatedly stated that TikTok U.S. is not for sale, and it’s exploring ways to keep the app running without a full divestiture. Board member Bill Ford recently hinted that ByteDance is working on a deal to address U.S. concerns while keeping TikTok under its umbrella.

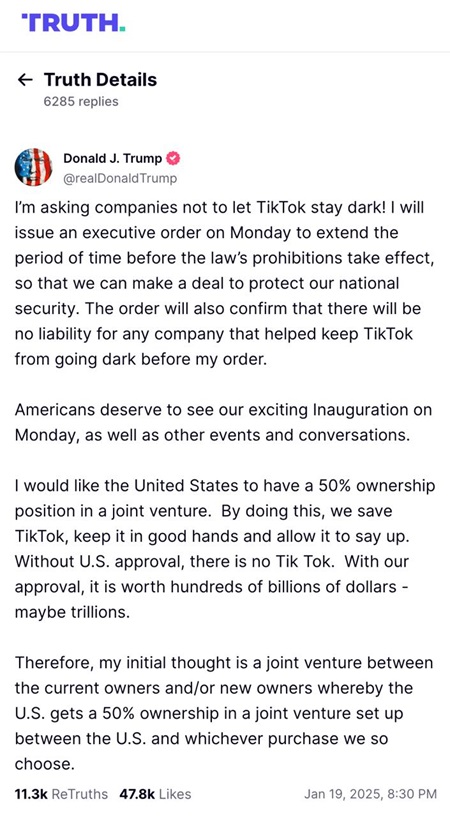

TikTok’s fate has been in limbo for over a year, leaving ByteDance and its investors on edge. The uncertainty has even caused ByteDance’s valuation to take a hit on private markets. Greg Martin of Rainmaker Securities noted that ByteDance is trading at a “huge discount” due to the TikTok drama. But he’s optimistic that the value of ByteDance could go up immeasurably once this is sorted out. Meanwhile, Trump’s proposal includes an eyebrow-raising idea: the U.S. government taking a cut of the sale. Classic move.

Even if TikTok dodges a ban, ByteDance isn’t exactly coasting on smooth waters. Recent reports have raised concerns about its handling of user data. AI startup DeepSeek allegedly shared South Korean user data with ByteDance, reigniting worries over Chinese tech firms’ access to sensitive information.

Elsewhere, TikTok has been rolling out new features in an attempt to keep users hooked, such as a broader rollout of the dislike button. But not all changes have been welcomed — some users are fuming that their “For You” page is now flooded with slideshows instead of actual videos. Meanwhile, CapCut, a popular TikTok-affiliated editing app, was mysteriously booted from the App Store in the U.S. before making a comeback.

The TikTok saga is far from over, and ByteDance investors have a lot riding on how things play out. A forced sale? A complete ban? Or a miraculous last-minute deal? Whatever happens, it’s clear ByteDance isn’t about to crumble just because the U.S. pulls the plug. The real show is happening in China, and ByteDance is still center stage, basking in the spotlight.

For now, American investors are just waiting for the final episode of this geopolitical drama. And if it doesn’t end soon, they’ll still have plenty of other profitable reruns to watch in China’s booming digital economy.

TechIssuesToday primarily focuses on publishing 'breaking' or 'exclusive' tech news. This means, we are usually the first news website on the whole Internet to highlight the topics we cover daily. So far, our stories have been picked up by many mainstream technology publications like The Verge, Macrumors, Forbes, etc. To know more, head here.